New target markets, company growth, technological innovations or the acquisition of competitors are usually accompanied by growth in product diversity in manufacturing companies. Typically, product portfolios consist of a mixture of standard and less demanded exotic products. Whether such exotic products should remain in the portfolio is often a matter of disagreement among the management of manufacturing companies.

Which products can be rated positively in terms of their financial and market-oriented key figures, but place a disproportionate burden on the production and logistics structure? What cost and performance potentials can be leveraged if logistically unfavorable products are removed from the portfolio? Scientists at the Institute for Production Systems and Logistics (IFA) are answering these and other questions in the research project “LoProBe – Logistical Product Portfolio Evaluation”.

Additional costs due to portfolio complexity

Well-known approaches to portfolio evaluation provide investment or disinvestment strategies for products under consideration of market and financially oriented variables. Specific methods, such as contribution margin accounting, take logistics costs into account. However, it is often not clear which additional financial expenses are caused by exotic products.

Additional financial expenses in the form of complexity costs arise, for example, from expanded inventories or the inefficient use of resources. These costs are often not properly allocated to the exotic products that cause them, but are also passed on to standard products. The resulting intransparency with regard to the advantageousness of individual products represents an obstacle to a targeted product portfolio evaluation.

Complexity in production logistics

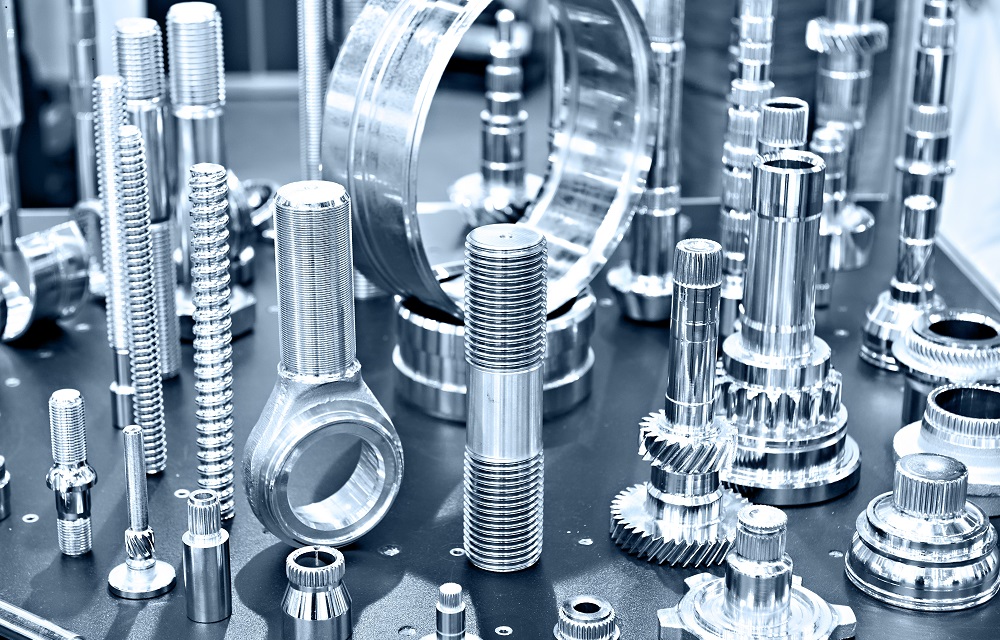

It is therefore necessary to take a close look at the causes of complexity-driven additional financial expenses and problems in production and logistics. For example, product groups that require special operating resources in the production process must be identified. An increase in the number of different types of equipment required for the resources is usually accompanied by an increase in the number of setup operations to be scheduled. Product groups that also have unclear requirement times and quantities further exacerbate the problems in order processing. A reasonable aggregation of customer orders into production lots is made very difficult.

Causal relationships between product characteristics (for example, the need for specialized equipment or unclear demand quantities and times) and logistical target variables such as logistics costs are currently being identified, described and clearly structured in the form of causal diagrams by the IFA.

Software-based portfolio evaluation

The IFA incorporates the findings from the causal relationships in an evaluation method for logistics-oriented optimization of product portfolios. The scientists are also developing a software application that will make it easier in the future to evaluate the current product portfolio and validly estimate the impact of a portfolio change on key production logistics figures.

Adapted to company-specific constraints and the existing data pool, data requirements are transparently displayed in the software application and explained using causal diagrams. Companies can then import relevant master and operational data and analyze the current portfolio.

The software application then makes suggestions for portfolio optimization. Portfolio alternatives are derived by removing individual products or product groups from the portfolio. The portfolio alternatives are then evaluated logistically, financially and market-oriented.

Companies wanted for practical test

The causal relationships derived in conjunction with the software-supported evaluation and optimization method should help companies in the future to evaluate products and product portfolios in terms of logistical, market and financial benefits. The effect of a portfolio change on logistic target values is to be estimated validly and quantitatively, but at the same time with low effort. This forms the basis for a holistic alignment of the product portfolio.

Companies interested in a prototypical application of the developed assessment method and software are invited to contact Tim Kämpfer at (0511) 762-19812 or by e-mail at kaempfer@ifa.uni-hannover.de.